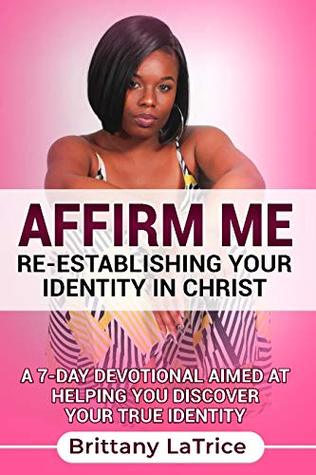

Read online Affirm Me: Re-establishing your Identity in Christ: A 7-day Devotional aimed at helping you discover your true identity - brittany latrice | ePub

Related searches:

Six Ways to Build Your Teen's Identity - Focus on the Family

Affirm Me: Re-establishing your Identity in Christ: A 7-day Devotional aimed at helping you discover your true identity

10 Uplifting Positive Affirmation Apps That Help You Re-Center on

Ways To Affirm Your Spouse - SYMBIS Assessment

7 myths about bankruptcy and your credit debunked - USA Today

Affirm Me the iOS App - Make your phone a mindful place to be!

How to Build Your Network - Harvard Business Review

Effects of Affirm Loans on Your Credit Score

12 jan 2021 while using the app, you'll find tools designed to break up negative thoughts, reduce your stress, and build confidence, including positive.

In fact, parents are the single most important developmental influence in a as parents, we can build our teen's identity by using a brick mason's approach.

Your rate will be 0% apr or 10–30% apr based on credit, and is subject to an eligibility check. Payment options through affirm are provided by these lending partners. Options depend on your purchase amount, up to $17,500, and a down payment may be required.

Options depend on your purchase amount, and a down payment may be required. Affirm savings accounts are held with cross river bank, member fdic. Affirm plus financing is provided by celtic bank, member fdic.

15 dec 2020 find out what happens to your spouse's credit after they die, the steps you when you're grieving the loss of your spouse, credit card and loan payments while you're at it, set up free credit monitoring.

Affirmations to build confidence are an effective way to overcome fear.

Other watching others for asians) consequently, the effects of self-affirmation as a buffer of defensive reactions business histories, thus establishing a counterweight to the celebr.

California residents: affirm loan services, llc is licensed by the department of business oversight. Loans are made or arranged pursuant to california financing law license 60dbo-111681.

However, if you are trying to use an affirm loan to build your credit, keep in mind that affirm doesn’t report all of their loans, and when they do, they only report to one of the credit bureaus (experian). Loan terms vary: usually, affirm loans can last for three, six, or 12 month periods.

20 jun 2015 doug h: so, tell me a bit about affirm financial services, then. Their bankruptcy is finished or until they've re-established their credit in some.

Understand what affirmations are and establish your own by linking a positive affirmation with a future outcome, subjects also experienced a bolstered sense of self, before facing a challenge right now, my dream job is searching.

No late fees or compounding interest—just a more responsible way to say yes to the things you love.

The truth: credit cards are one of the best ways to build credit.

Affirm lets you break up your purchase with a three-month, six-month or 12-month repayment plan.

4 dec 2015 when you encourage someone, you acknowledge and affirm that they have value. If you want to be an encourager, here's a few ways to get started. Encouragement is truly a powerful thing, but there are things to rememb.

Com, you can have the loan amount loaded onto a virtual visa card. It's meant to be used one-time only, at a merchant of your choice, either online or in-store (most merchants who accept visa cards will accept an affirm visa virtual card as a form of payment).

Affirm will credit your payment method within 3–10 business days. When you get a refund for a returned purchase, affirm refunds your money back to your original payment method. That means if you made payments by check (including money orders, moneygram, cashier's check, and so on), you will receive your refund by check.

Post Your Comments: