Read online Blind Robbery!: How the Fed, Banks and Government Steal Our Money - Philipp Bagus file in PDF

Related searches:

Blind Robbery!: How the Fed, Banks and Government - Amazon.com

Blind Robbery!: How the Fed, Banks and Government Steal Our Money

Blind Robbery!: How the Fed, Banks and Government - Goodreads

Blind Robbery! How The Fed, Banks And Government - Mises Store

Blind Robbery!: How the Fed, Banks and - Barnes & Noble

Blind Robbery: the Bestseller of Philipp Bagus and Andreas

Blind Robbery! How the Fed, Banks and Government Steal Our

ImCfD [Download] Blind Robbery!: How the Fed, Banks and

Blind Robbery! How The Fed, Banks And Government Steal Our Money

Marquart bagus blind robbery how the fed, banks and

[PDF] Blind Robbery!: How the Fed, Banks and Government Steal

Buy Blind Robbery!: How the Fed, Banks and Government Steal

The Federal Reserve System and Central Banks Macroeconomics

Robbing the Federal Reserve and Getting Away With It - Doug

How the Fed and ECB will let banks go bust in a new monetary

The Fed's system that allows banks to send money back and

The Fed and the ECB: Two Paths, One Goal Mises Institute

inspector clouseau and the blind beggar - YouTube

The Fed, Banks, and How I'm Trading JP Morgan - RealMoney

The Rothschild’s Global Crime Syndicate and How It Works

How banks and the government rob you blind

The first US central bank - illegally funded and robbed the

The Capital Letter: Central Banks and Climate Wars, Turkey's

Twitter and the Federal Reserve: How the U.S. central bank is

Jack Ma’s Ant Group Further Exposes The Fed And Central Banks

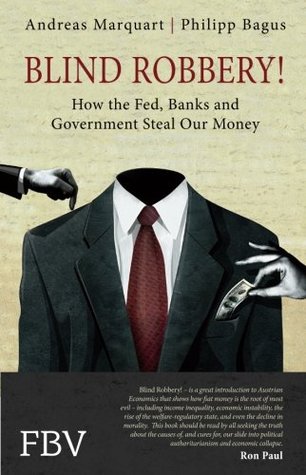

BLIND ROBBERY!: HOW FED, BANKS AND GOVERNMENT STEAL OUR By

Unstuffing banks with Fed deposits: Why and how VOX, CEPR

Blind Bob The Bank Robber

How to Rob a Bank - The Fed Who Robbed the Bank

How the New York Fed fumbled over the Bangladesh Bank cyber-heist

Why the Fed Is Ending Its Big Covid Break for Banks

Fed's Discount Window: How Banks Borrow Money From The U.S

The Great Bank Robbery: How the Federal Reserve is destroying

Part 1: The Blind Bankrobber – A Story About Cybersecurity

The blind Federal Reserve - Coppola Comment

Federal Reserve Board - About the Fed

Only An Idiot Would Rob a Bank: How Inflation Deflated the

Top 25 Heist and Bank Robbery Movies - IMDb

How central bankers learned to love financialization: The Fed

100 Years Later, The Federal Reserve Has Failed At Everything

How the Federal Reserve Was Formed - Investopedia

The Fed Has Robbed the Future – The Burning Platform

The Fed is yanking away big banks' 'get out of jail free

How the Fed Affects Interest Rates Interest.com

Savings and loan crisis - Wikipedia

The Billion-Dollar Bank Job - The New York Times

Inflation and Central Banks St. Louis Fed

Why Does the Federal Reserve Regulate Banks?

How Does the Fed Raise or Lower Interest Rates?

The FBI Questioned The Screenwriter of 'Die Hard with a

Has the Federal Reserve Bank of New York ever been robbed

Fed to end relaxed capital requirements for large banks - The

How the Fed could rewrite the rules for fixed income

How the “world’s first Bitcoin bank” was robbed blind Ars

'Money washing': Here's how the Federal Reserve is bailing

Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s

Fed Tasks: The Government's Bank - How the Fed Works

The fed's system that allows banks to send money back and forth went down for several hours jeff cox 2/24/2021. Slain colorado officer, father of seven, sought new life away from front line dangers.

Central bank is (and is not) surviving social media peter conti-brown and brian feinstein thursday, october 29, 2020.

How the fed, banks and government steal our money (english edition) ebook: bagus, philipp, marquart, andreas: amazon.

Here’s how the federal reserve explains it: the fact that banks are required to keep on hand only a fraction of the funds deposited with them is a function of the banking business. Banks borrow funds from their depositors (those with savings) and in turn lend those funds to the banks’ borrowers (those in need of funds).

The federal reserve said on friday that it would not extend a temporary exemption of a rule that dictates the amount of capital banks must keep in reserve, a loss for big banks and their lobbyists.

During the most recent bank robbery at mission federal credit union in el cajon, one robber was identified to be approximately 30-years-old and around 5 feet 6 inches or 5 feet 9 inches in height.

The fed decided to keep restrictions on banks buying back stock and paying out dividends through march after completing round 2 of bank stress tests.

Haha i came in here to defend this movie but it turns out im not the only one who liked this movie. Btw without giving away too much, the premise of the film is no one would ever suspect blind men to have robbed a bank, so they were the perfect guys to have carried out the master plan.

How the fed, banks and government steal our money by bagus, philipp, marquart, andreas (isbn: 9783898799829) from amazon's book store.

In fact, i think probably to some extent, they’ve gotten a bit better. Instead, we do see that the major central banks, the bank of japan, the european central bank and the fed have all had some problems to one degree or another in hitting their desired rates of inflation. The bank of japan has had essentially almost no inflation since about.

Blind robbery: the bestseller of philipp bagus and andreas marquart published in english financial consultant and together with philipp bagus author of “blind robbery.

Today we consider how the next banking crisis could lead to a new monetary reset and how the ecb and the fed could let the banks go bust.

Second, central bank tampering with interest rates is the fundamental cause of, not the cure for, the boom and bust cycles; thus, the fed should cease from tampering with interest rates.

How the fed, banks and government steal our money collection best.

How the fed, banks and government steal our money [bagus, philipp, marquart, andreas] on amazon.

The fourth echelon explained below, are almost all the central banks in the world that are similarly owned by the rothschild family. To name but a few, these are the central bank of england in the city of london, the vatican bank in rome, and the federal reserve in washington dc, and the european central bank – the ecb in frankfurt am/m.

Fed says banks will have to wait until june 30 to start issuing buybacks and bigger dividends published thu, mar 25 2021 4:30 pm edt updated thu, mar 25 2021 6:14 pm edt jeff cox @jeff.

The fed, banks, and how i'm trading jp morgan the federal reserve came to some conclusions based on the results of two hypothetical worst case type scenario simulations that put the nation's.

It's a must read for anyone seeking to understand how states and their central banks undermine real prosperity. Jeff deist, director of the misesinstitute (auburn, alabama)“'blind robbery!' is a great introduction to austrian economics that shows how fiat money is the root of most evil—including income inequality, economic instability, the rise of the welfare-regulatory state, and even the decline in morality.

Washington -- the federal reserve said temporary limits on dividend payments and share buybacks will end for most banks after june 30, following the completion of annual stress tests to determine.

Under the federal reserve act of 1913, each of the 12 regional reserve banks of the federal reserve system is owned by its member banks, who originally ponied up the capital to keep them running.

Blind robbery!� how the fed, banks and government steal our money.

As with the fed it's a privately owned bank, who's owners make money off the interest they charge interest on our own money making a killing for doing nothing. Well this first bank, the bus (bank of the united states) was set up with 80% private investors and 20% being funded by the us government at $2 million investment.

The federal reserve says it will restore capital requirements for large banks that were relaxed as part of the fed's efforts to shore up the financial system during the early days of the pandemic.

The growing fed consensus for the new approach emerged over the past two years in a series of research papers and public statements from fed officials and the presidents of the federal reserve banks. The long-discussed change will become a permanent part of the postpandemic landscape.

Federal reserve pumped trillions of dollars into a financial system rocked by the coronavirus pandemic.

A focus on the fed and other central banks is so backwards, so 19 th century.

But it wasn’t until the 2007 release of the die hard collection on dvd that i became fascinated with the movie’s major set piece — the robbery of the federal reserve bank.

Use advanced search criteria to find a bank or bank holding company, generate comprehensive financial or demographic reports, and find bank locations or groups of banks. Central data repository (cdr) obtain reports of condition and income (call reports) and uniform bank performance reports (ubprs) for most fdic-insured institutions.

Washington -- the federal reserve said it was ending a yearlong reprieve that had eased capital requirements for big banks, disappointing wall street firms that had lobbied for an extension.

The three have targeted banks from long beach to pasadena and most recently barged into a bank branch in artesia on april 28, according to detectives with the lapd’s robbery-homicide division.

A federal reserve bank panel stated the resulting taxpayer bailout ended up being even larger than it would have been because moral hazard and adverse selection incentives that compounded the system's losses. Some state insurance funds failed, requiring state taxpayer bailouts.

Fed purchases of those quality bonds inject dollars into the economy. That provides banks, businesses and pension plans with cash to pay to employees, retirees and vendors.

Jun 20, 2016 editor's note: philipp's terrific new book “blind robbery! how the fed, banks and government steal our money” is now available (publisher:.

The federal reserve bank of new york has a trading desk that engages in daily open market operations. For the first part of the morning, they adjust the level of securities and credit in banks' reserves to keep the fed funds rate within the targeted range.

The federal reserve, the central bank of the united states, provides the nation with a safe, flexible, and stable monetary and financial system.

Faster than mining — how the “world’s first bitcoin bank” was robbed blind attacker overwhelmed the system, then withdrew $600,000 worth of bitcoins.

Banks that capital requirements loosened as the coronavirus pandemic raged will return to normal at the end of the month.

The federal reserve says it will restore capital requirements for large banks that were relaxed as part of the fed’s efforts to shore up the financial system during the early days of the pandemic.

That single word, by a stroke of luck, helped stop the federal reserve bank of new york from paying nearly $1 billion to the cyber-criminals behind a notorious bank.

In this way, both the fed and banks could observe whether, and by how much, the latter’s balance sheet expansion was (in-)compatible with the fed’s desired reserve path. The (market) interest rate that emerged from this and the eventual volume of discount window borrowing thus could serve as indicators for both the fed and banks to correct.

Blind robbery! how the fed, banks and government steal our money. Editor’s note: philipp’s terrific new book “blind robbery! how the fed, banks and government steal our money” is now available ( publisher: finanzbuch verlag (june 6, 2016)).

Now anticipation is growing about how the nation’s largest banks will perform on the fed’s latest round of stress tests. Besides this year’s addition of the “sensitivity analyses” that take into account the economic shock caused by the pandemic, the fed in march finalized a stress capital buffer that may result in higher capital requirements for the largest banks.

(joshua roberts/reuters) the week of march 22: central banks and the climate wars, spend, spend, spend, turkey’s collapsing lira, and much, much more.

The fed's membership in the ngfs, formalized last week by a 5-0 vote, comes more than a year after the central bank began participating in discussions with the group. The fed's vice chair for supervision, randal quarles, told the wall street journal last month the central bank had requested membership.

The federal reserve faces a decision in the coming days over whether to extend relief that temporarily loosened restrictions for the way big banks account for ultrasafe assets such as treasury.

Blind robbery! how the fed, banks and government steal our money.

Although bank stocks fell on the news friday, there could be a silver lining for wall street: allowing the relief to expire could ease pressure on the fed to limit bank dividends and share buybacks.

The fed's actions critically affect the way banks and financial markets behave, and this in turn impacts on the real economy. Yet it does not appear to understand the financial system that is emerging as a result of regulatory and market changes since the crisis.

Farrell and maria wilhelm the way robert vernon toye sees it, he had no choice but to live a life of crime. But then the forty-two-year-old bank robber's hindsight has always been 20-20.

A big us bank is an organisation of mind-numbing complexity, but abstracting from much detail, it is 1) a bank that is regulated by the office of the comptroller of the currency (occ), the fed or the federal deposit insurance corporation (fdic), 2) a publicly-held bank holding company (bhc) regulated by the fed, and 3) a broker-dealer regulated.

Morgan and other prominent financiers, congress eventually formed the federal reserve act in 1913, establishing the fed as america's central bank.

How the fed, banks and government steal our money - kindle edition by bagus, philipp, marquart, andreas.

In addition to the suntrust bank robbery, roberts was charged with the armed robberies of the wells fargo bank at 10422 abercorn street in savannah on july 25 and august 8, 2017.

Jun 14, 2016 financial consultant and together with philipp bagus author of “blind robbery.

So the federal reserve, caught up in the euphoria, happily slashed interest rates and the banks, in cooperation with wall street, began to underwrite dangerously risky loans and subprime mortgages. Exactly how dangerous was revealed last year with the collapse of the us housing markets.

Jun 15, 2016 andreas marquart and philipp bagus show you how money arises and why our current money is bad money.

In this post and the next, we will use a bank robbery as a metaphor for a cybersecurity breach to explain how bad guys get in, how they find valuable information and how they get out with the goods. We will also describe the places where cyberdefenses can help.

“the fed” is a nickname for the federal reserve system (frs). The frs is a collection of 12 regional banks across the country that serve as the central bank for the united states. Each of these regional banks serves a specific geographical region and is further broken down into smaller branch offices.

Fuzzier federal reserve targets are creating a fog for other central banks and for investors gauging the next upswing in the interest rate cycle over the coming years.

The earliest recorded bank robbery in the united states took place in 1798 in philadelphia, in the bank of pennsylvania at carpenter’s hall. Patrick lyon, a young blacksmith was contracted by a man named samuel robinson to forge locks for the bank’s new location.

The fbi had had a major role in federal bank robbery cases going back to the 1930s. That was when john dillinger and his gang were conducting bank robberies across the midwest. It was in 1934 that it became a federal crime to rob a national bank or a state member bank that is part of the federal reserve system.

How the fed, banks and government steal our money (inglese) copertina flessibile – 6 giugno 2016. Di philipp bagus (autore), andreas marquart (autore) 4,8 su 5 stelle.

The federal reserve will let a significant capital break for big banks expire at month’s end, denying frenzied requests from wall street.

Post Your Comments: